Newsletter August 2017

Newsletter August 2017 https://guardianfinancing.ca/wp-content/themes/corpus/images/empty/thumbnail.jpg 150 150 Guardian Financing Guardian Financing https://guardianfinancing.ca/wp-content/themes/corpus/images/empty/thumbnail.jpgWelcome to the Guardian Financing August 2017 monthly newsletter. This month’s issue is a recap of the recent interest rate hike, and its impact on the Toronto and Quebec markets, respectively.

Recap of the Recent Interest Rate Hike

Although the BoC has stated that the economy is strong and is “approaching full capacity”, that “inflation is approaching the 2% target”, and that they believe “the economy can handle” the interest rate increase, Guardian Financing has explored a few concerns, possible outcomes, and will review how some individuals may be impacted by slightly steeper interest payments.

In fact, interest rates rose more significantly, and much earlier than expected.

According to a new Ipsos poll conducted via MNP Debt, approximately 50% of Canadians would be concerned about their ability to pay their debts if rates were to go up. In addition, a third of Canadians stated that this would push them closer to bankruptcy.

The poll predicted that 48% of Quebecers would be concerned about their respective debt loads, following an interest rate rise.

Let us begin by reviewing some of the factors that may impact the Canadian housing market.

Overview of Toronto’s Housing Market Drop

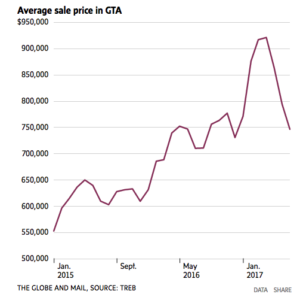

Firstly, we must note that the Toronto real-estate market has recently started to depreciate. This means that homes that were recently purchased by first time homebuyers and real-estate investors at higher prices, may become significantly devalued.

As per an article published in The Globe and Mail on August 3, 2017, “home prices in Toronto have fallen 19 % since the market’s peak in April, sliding further in July, as buyers continued to sit on the sidelines while waiting for signs of stability.”. As implied here, the secondary effect of such a market crash is reluctance to enter or exit the market, as some potential sellers are waiting for the market to recover, while prospective buyers are holding out for it to hit bottom, prior to making any purchase decisions and putting through an offer. Buyers do not want to overpay, should the market continue to descend, while sellers may refuse to sell at such a loss, and may choose to await a recovery in the near or long-term. Generally, when fewer homes are sold, a decrease in housing prices tends to follow.

There are also 16 new measures, including a new 15% tax that has been introduced in April, for foreign investors throughout Ontario, as part of an attempt to cool housing prices, which seems to be working.

In addition, the Canadian dollar has recently been showing signs of strength, which makes Canadian real-estate more expensive for foreign investors.

How Interest Rates May Impact the Quebec Market

A combination of the above factors may impact the local Quebec housing market in a number of ways.

A volatile Ontario real-estate market may make investment in Quebec’s real-estate market slightly more attractive to foreign investors, although, the 19% drop in Ontario’s housing market may outweigh the deterrents of a higher Canadian dollar, and the 15% tax that is applicable to them.

As a result of increased interest rates, many potential buyers will be disqualified, resulting in a decrease in sales.

Various analysts predict a slowdown throughout the Quebec market as interest rates have increased by two to three times the amounts that were originally anticipated in January 2017, and earlier than expected.

Guardian Financing is a direct mortgage private mortgage lender. We serve the greater Montreal area, providing short term residential mortgage loans, typically ranging from $50,000 to $500,000. Contact us today to discuss your file at 514-700-3121 or by email at files@guardianfinancing.ca.

- Posted In:

- Uncategorized